Different Types of Cashless Payments & Its Major Benefits: Moving Towards a Cashless Society

With the advancement in technology, we are moving ahead at a very quick pace. One more technology which we are grasping very quickly is going cashless. It is one of the reasons why digital eWallet Mobile app development companies are working relentlessly to come up with seamless and secure payment methods for the consumers.

As per the current rate. We are soon going to replace physical cash with digital money. Recently, the world’s largest population India beats China with whooping 25.5 Bn digital payment transactions in 2020.

Just like India, many countries across the globe are making efforts to remove every kind of cash that circulates in their country, and Sweden is its prime example as they are all set to become the first cashless nation in the world by 2023.

Sweden buses haven’t taken cash for years, 900 out of Sweden’s 1600 bank branches do not accept cash deposits. The question is are they forcing people to go cashless? And the answer is no, it is the ease that comes with digital payments. Just take out the phone or card and your payment is done in seconds.

FUN FACT – India being the biggest digital payment country still has not implemented a complete cashless policy in the country and the buses in India still run on cash.

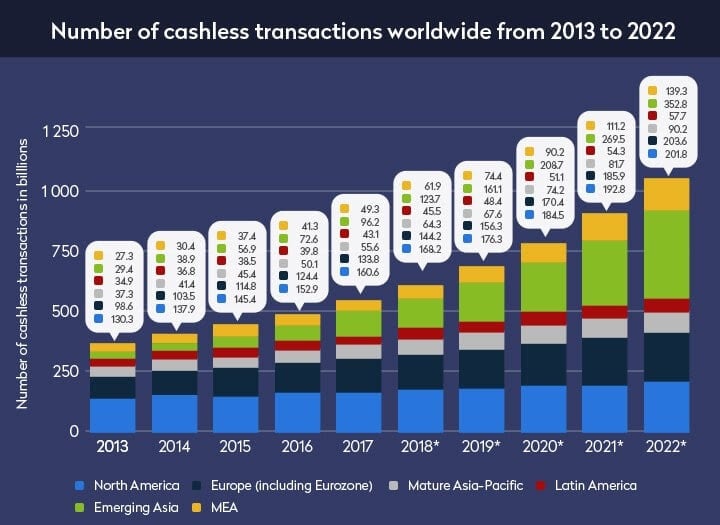

But this impact of cashless payment is not limited to some countries or to Sweden. Here we have a graph which shows an increase in cashless transactions over the years in different regions. The above trend shows the importance of eWallet mobile app development company in the near future. This graph shows the whole world is going to soon become a cashless society.

However, people still have questions in their minds about this cashless society. Like what exactly is a cashless society? What are the different types of cashless payments that drive a cashless society? And most importantly what are the major benefits of a cashless society? So let us understand all this in great detail.

What is a Cashless Society?

A cashless society can be defined as a state or a concept where all the financial transactions take place through the transfer of digital information instead of any kind of banknotes or coins. Earlier cashless societies used to exist as there are many exchange methods which were known as barter systems. Cashless payments are part of our society for so long as we are seeing debit cards, credit cards, point of sales, mobile wallet apps by digital eWallet mobile app development company, internet banking, mobile banking, etc.

Types of Cashless Payments

There are several ways in which you can make payments without cash so let us have a look at them one by one.

Banking Cards –

Usually, there are two types of banking cards that are the most used cashless payment methods across the world. Banking cards offer convenience at almost every store, secure payments, and many more. Another advantage of banking cards is that they can also be used for making other types of digital payments. For instance, a user can save the card information in their mobile wallets to make cashless payments. You can also use these cards on PoS machines, internet banking, online transactions, etc. The top and most secure names like Master Card, Visa, Rupay when it comes to banking cards.

USSD –

USSD stands for Unstructured Supplementary Service Data as it is a cashless payment option for those who don’t have a smartphone. Its unique selling proposition is to make it easy for the user to make payments without a smartphone device or internet facility.

The user needs to dial *99# to interact with the voice menu via a mobile screen, but the mobile number must be the same as that one linked with the bank account. If you have ever heard of IMPS, and it uses MMID and MPIN with mobile number or account number with IFSC code for successful transactions then USSD is very similar to that payment option.

Mobile Wallet Apps –

Mobile wallet applications from eWallet mobile app development company are the future of cashless payments. It is because it’s fast, secure, and offers convenient payment methods. These digital mobile applications allow the user to send, receive and store money. Users can add or store money in the respective wallet by simply linking them to his/her bank account.

The top convenience offered by digital eWallet app development companies in these applications is the user can also send money to his friends, relatives, or any other person just by entering a phone number, unique ID, or scanning QR code. A user can also make payment merchants and can easily pay simple utility bills like water bills, electricity bills, mobile recharge directly from your mobile wallet app.

QR Codes –

QR stands for Quick Response as it is a two-dimensional code that has a unique pattern of black squares which are arranged on a square grid. These QR codes are read by imaging devices such as smartphone cameras. QR codes can be seen worldwide for making cashless payments in which the user just has to scan the QR code of the merchant service to complete the transaction.

Contactless Payment –

Contactless payments are also widely used to make cashless payments as it is one of the convenient and secure methods to complete the purchase by making the payment. It can use any car whether it is a debit, credit, or a smart card as they are enabled with a chip-based on NFC or RFID technology.

The best feature that makes contactless payments convenient is it doesn’t require any signature or PIN as you can also make contactless payments via NFC-enabled phones as eWallet mobile app development companies are working to directly link it with a mobile wallet.

ECS –

ECS stands for Electronic clearance service as it is also widely used when it comes to making bulk payments which are equated in monthly or weekly installments or paying off for utility services, and to disburse payments like pensions, salaries, or dividends interests. ECS can be used for both to debit or credit the amount.

To make ECS a simple task, and authorization has to be provided by the bank for making periodic credits and debits. ECS is also a safe method as it allows you to provide instructions for the maximum sum of debit, validity period, and the purpose of the transaction.

Gift Cards & Vouchers –

Gift Vouchers are also among the great ideas to go for cashless. It enables the receiver to buy anything with the help of a voucher. There are many stores that offer discounts on gift vouchers.

PoS Terminals –

PoS terminals are nothing but handheld devices that are present at the stores. These devices are used to read the banking cards of the customers. However, the PoS is increasing day by day as these services are now available on various mobile platforms via the internet. Due to the latest technologies, PoS can be bifurcated into different types of Physical PoS, Mobile PoS, Virtual PoS, etc. If we go deeper then Mobile PoS is beneficial for small businesses as they operate through smartphones and tablets so it doesn’t need a large investment.

As we have seen the different types of Cashless Payments now let us have a look at their benefits.

Major Benefits of a Cashless Society

Reduced Costs and Business Risks

Cashless Payments eliminates many business risks like theft of cash by employees, robbery of cash, counterfeit money. Moreover, it also diminishes the costs of security, transporting, withdrawing cash from banks, and counting.

Transaction Speed

When it comes to cash payment then it is time-consuming for customers as well as the merchant or employee. It is one of the reasons why many businesses have decided to go cashless to offer convenience to the customers by offering faster transactions and increased efficiency. As mentioned, quick transaction speed enhances customer satisfaction, increases revenue, and fewer errors.

Seamless International Payments

If you want to order something online from another country then you can’t do it through cash. You need to have cashless payment solutions by digital eWallet mobile app development companies as they easily make the transactions directly from their cashless payment apps.

Better Record of Economic Data

Government and other organizations spend a lot of money many times in order to gather data of real-world transactions of citizens. This process is costly, time-consuming, and less efficient. But with the recorded financial transactions it is easy to track the movement of money through these records. These records are very helpful as they help in tracking black money and other illegal transactions.

Eliminating the Middleman

After reading the above points we are sure you have understood that this concept is more than just a shift from cash payments to cashless payments. The reason behind this is that the mere shift won’t have a major impact until the whole world including the private companies process online transactions. The cashless payment also removes the middlemen and saves a ton of money that goes to them. A truly cashless society along with the last mile of money transfers, payments, banking services, etc they play a major role in becoming a cashless society.

Conclusion

We are not completely into the cashless society as it seems it will take a few years to achieve this. But we have already taken the step towards it and with constant improvement in existing technologies we will see a positive shift in cashless payments than ever, so we become a cashless society.

Also Read: 8 Top Digital Payment Trends for 2021