How COVID-19 has Impacted the Business Continuity and Developing a BCP in Response

The world today is fighting the situation, none of us anticipated! Coronavirus or COVID-19 struck the world in the most unanticipated manner and it is definitely painful to hear, but we were certainly not prepared. From healthcare to businesses, industries to global markets, COVID-19 pandemic has disrupted the business continuity in a manner, no one ever imagined. It is easy to fly resources from one place to another, but how to run businesses when the flights are landed and borders have been sealed? Businesses across the world are facing twin challenges – business continuity and growth! The IT and BPO sector in India is almost $190 Billion and right now, one of the biggest challenges that it is facing is – to keep business functioning! Since, travel, hospitality and aviation are facing the major blow, there will be a dip in the growth of IT spending by these industries in particular, in the time to come.

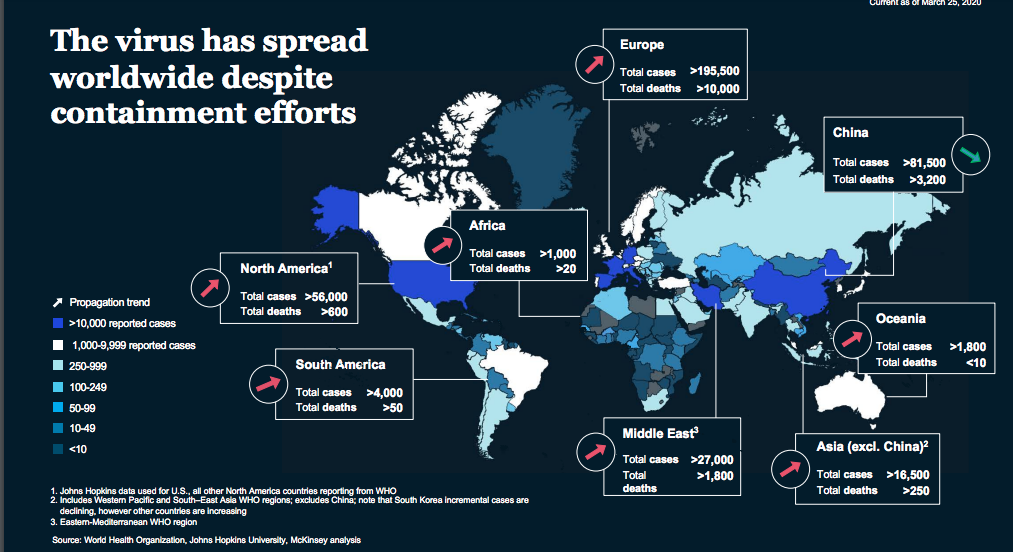

As per Worldometer, around 5.38 lakh people are currently affected and by the time you will read this article, the number might be even higher. With record cases in China, USA, Italy, Spain, Germany, France and Iran, the infection is continually rising and almost 199 countries and territories across the world have been affected. So, amidst all this when the death toll is on the rise, industries and businesses are left with almost no options than to wait and watch as to how the situation unfolds. In this grave situation, the businesses across the globe are faced with even bigger challenges, to ensure the safety of their personnel on the one hand, and maintaining a high-quality and stability of services for the clients on the other. IT is the key enabler for businesses and industries across the world, and with COVID-19 crippling a majority of them, it is difficult to estimate the probable losses for tech now! This is indeed the toughest phase for all of us, with major economies of the world hit and people across the world locked down in their homes, the impact is going to be massive.

The question that arises is “ Whether we or our Business Continuity Plans (BCPs) were even prepared for this global pandemic?” These plans are indeed in deep waters right now! CFO of a leading FMCG company stated on the condition of anonymity to Economic Times, “ I have 18 factories across India. The BCP was to shift manufacturing from one zone to another if there is a problem. But the BCP has gone for a toss now that 24 factories are under lockdown and staff is sitting at home.” So, it all boils down to business continuity now!

With industries such as aviation, travel, tourism and hospitality being the ones that are majorly hit, the CFOs are under immense pressure and a lot of stress lately. Amit Jaiswal, CFO, Royal Orchid Hotels states “ I am taking reports of 61 operational hotels on an hourly basis. The past few weeks have been very stressful. From March 10 onwards, we started reducing our costs. But they can’t be made zero. We still have to maintain operating hotels and that involves some costs. We don’t know when the situation will improve. We are trying to keep our nose above the water. The biggest challenge is with the hotels that have got loans and debt.”

Now, coming to the IT industry, it has its own set of challenges. Asking personnel to work from home brings challenges and issues like increased risk of data theft and loss, leak of sensitive business information and many more. Besides this, the DoT rules usually do not permit office VPN to connect to home IT infrastructure but with the pandemic taking a heavy toll on human lives, the Department of Telecommunications on March 13, temporary relaxed the ‘work from home’ relaxations for Other Service Providers (OSPs). OSPs include call centres, KPO and BPO centres, medical transcription companies and other such entities. “ Even after the government allowed work from home for IT-BPO firms, data centres and eCommerce, companies are facing challenges in convincing local authorities on movement required to shift equipment to homes and to enable a small number of staff to commute for mission-critical work,” said Ashish Aggarwal, senior director of industry body Nasscom.

As per the report COVID-19: Implications for Business by McKinsey & Company (updated as on March 25, 2020), based on the interplay between the virus and the society’s response to it, there are two ways in which the scenarios might unfold. The report has stated the said scenarios and the implications on the economy in each case as follows:

Scenario 1: Delayed Recovery

In the said scenario, new cases continue to rise in the U.S. and Europe until the mid-April. While the Asian countries peak earlier, the spread is limited in Africa and Oceania. Growth in the number of positive cases will be slowed down by measures such as national and local quarantines for social distancing, restricted travel by employers, work-from-home policies and other individual choices. The virus proves itself to be seasonal, thereby limiting its spread. So, public sentiment is likely to be more optimistic regarding the epidemic by mid-May. There will be a resurgence of infections in the autumn of 2020 but better preparedness will effectively enable the economic activities to continue.

Economic Impact: There will be a sharp dip in the consumer and business spending until the end of Q2 pertaining to the social distancing, restrictions in travel and large-scale restrictions, producing a recession. Although the control measures remain successful in getting hold over the outbreak in most of the parts of the world, the self-reinforcing dynamics of the recession will kick in and prolong the drop until the end of Q3. There will be significant pressure on the banking and financial system pertaining to the increase in business investment contracts and corporate bankruptcies.

There is a limited impact of monetary policies that were eased during the Q1, given the prevailing low-interest rates. To overcome the damage in Q2 and Q3, modern fiscal responses will prove to be insufficient. The European and US economies see a genuine recovery by Q4 and global GDP sees a slight fall in 2020.

Scenario 2: Prolonged Contraction

In the said scenario, the epidemic does not peak in the U.S. as well as Europe until May, pertaining to the delayed testing and weak adoption of the social distancing measures which will hinder the progress of the public-health response. The virus is not seasonal, thereby leading to a long-tail of positive cases through the rest of this year. Regions of Africa, Oceania and some in Asia experience the widespread epidemic while the countries that have a higher section of the younger population experience few deaths. Some countries that successfully controlled the pandemic, are still forced to keep some of the health measures in place as a precaution in order to avoid the resurgence.

Economic Impact: The consumers cut on their spending as a result of which the demand will suffer throughout the year 2020. The number of corporate bankruptcies and layoffs continue to soar, in the worst affected business verticals throughout the year 2020, thereby feeding the self-reinforcing downward spiral. The banking systems will eventually suffer significant distress and fiscal along with monetary policy prove to be insufficient to break the downward spiral. The global economic impact is massively severe, approaching somewhere the global financial crisis of 2008-09. Major economies see a contracted GDP in 2020 and the recovery begins only by Q2 in 2021.

The said report by McKinsey & Company has suggested that the leaders across the globe need to think and act across the five horizons, given as follows:

1. Resolve: There is a need on the part of corporates and leaders to immediately address the challenges and issues that COVID-19 poses for the institution’s personnel, technology, clients, customers, business partners and other stakeholders.

2. Resilience: Address the cash-management challenges for the near-term and broader issues relating to resilience during shutdowns or lockdowns due to the virus and the corresponding economic effects.

3. Return: Creating a detailed and robust plan to return to the business operations and bringing back the business on the scale as quickly as possible as the virus evolves and the effects become visible and more clearer. Here, the companies should be prepared for the “return” i.e. protect the employees, re-assure the customers regarding a “safe environment”, restore the supply chain and the business practices that need to be reinstated, revised or even removed.

4. Re-imagination: It will be all about to re-imagine the “next-normal”. So, in this phase of re-imagination, there is a need to ask questions like “Could you really emerge in a new normal and how?”

5. Reform: Here, it is important to have a clear view of how the competitive and regulatory environment in your particular industry may shift. Resetting to a new normal is quite difficult indeed but the speed and effectiveness of the response from the countries across the globe could reshape the political and economic relationships worldwide.

There are some other concrete measures as well that the IT sector has opted for in order to maintain the continuity of the business. Amongst various other measures, there is an option for the companies to use bots for work like software testing although this is not entirely risk-free from attacks that take place virtually.

For those who are into mission-critical services, IT companies are educating their employees along with offering relevant information regarding the outbreak and keeping a panel of doctors and specialists on standby. Companies have increased their use of remote working systems as well as conferencing facilities in order to communicate with teams that are working remotely or in other countries.

Also, it is the right time to test and adopt blended environments by making use of both physical and virtual collaboration tools.

The sectors which are more capital-intensive, and in which the foremost requirement would be for the capital, the focus should be to ensure that there is pretty less stress on the cash-flow cycle and once the situation gets back to normal, the raising of funds is re-initiated as early as possible. Right now, to maintain business continuity, it is a fairly good idea to defer and suspend Capex and run on the bare minimum essentials to smoothly ride through the grave situation.

Last but not least, keeping your clients informed is something very essential for business continuity in these uncertain times. Since the implications are far-reaching, the investment teams should closely monitor the situation and provide a timely view through the company’s website, social media channels and of course, via email as the situation evolves and demands. There is a need to enable the clients to ask questions and get timely responses for better management of the current situation. After all, the collaboration will continue to be the key for effective execution of day-to-day operations for organizations across the globe.